Maintain Tax Groups

The Maintain Tax Groups routine allows the user to establish and maintain the Tax Groups that are to be used throughout the system. Tax Groups are combinations of Tax Structures; these combinations may make up a Compound Tax Structure, or may simply be a combination of the taxes that are used in a specific area. Tax Groups are assigned to specific areas (Offices) through the Maintain Office Tax Groups routine. This routine should be used with caution, as it will affect all Billing amounts and procedures.

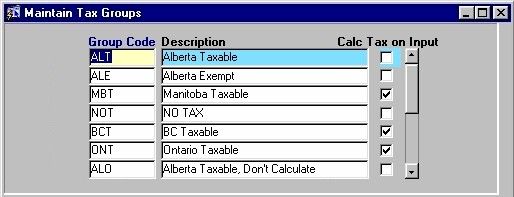

When the Maintain Tax Groups routine is accessed from the eQuinox main menu, the screen shown below will be displayed.

Field Definition

Group Code - The code assigned to the Tax Group (the Tax Group's unique identifier).

Description - A description of the Tax Group.

Calc Tax On Input - The Yes/No (checked/unchecked) value of this field indicates whether or not the tax for this Tax Group is calculated automatically when work is entered into the system. Note: Tax amounts that are automatically calculated at the time of input can still be overwritten by the user at the time of entry.

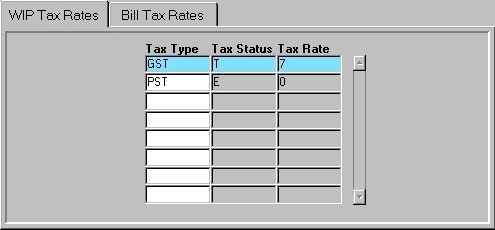

The Bill Taxes and WIP Taxes tabs display details specific to the Tax Group selected in the first section. For example, in the screen sections shown here, the information in the WIP Taxes tab is specific to the Alberta Taxable Group (shown above in blue). If the user were to select a different Tax Group, the information in the Bill Taxes Tab and the WIP Taxes Tab would change to the details for the selected Tax Group.

The Bill Taxes tab displays information about the individual Tax Structures that make up the selected Tax Group. Bill Taxes are the taxes applied to Client Bills. For more information on Bill Tax Rates, see the Glossary.

The WIP Taxes tab displays information about the individual Tax Structures that make up the selected Tax Group. WIP Taxes are the taxes that are applied to Works In Progress.

For more information on WIP Tax Rates, see the Glossary.

Note: - To add new Tax Groups, the user must first create the Group Code and Description, and then select the Taxes from the Bill and WIP Tax Rates tabs that are to be included in the new Tax Group. A Tax Group cannot be duplicated (i.e. you cannot have two "BC Taxable" Tax Groups), and Tax Groups cannot be deleted if there are either Bill or WIP Tax structures associated with the Tax Group, or if there are transactions currently in the system that involve that Tax Group.

Since the fields in the WIP Tax Rates and Bill Tax Rates tabs are identical, they are only defined here once.

Tax Type - The type of Tax Structure. This value will be displayed once the user makes a selection from the List of Values provided in the next field.

Tax Status - The Status of the Tax Structure (i.e. Taxable, Exempt, Zero Rated). A selection may be made from the List of Values provided. Once a selection is made, the Tax Type and Tax Rate are also displayed. Note: The Tax Types that are displayed in the List of Values are those that were created in the Maintain Taxes form. To add a new Tax Type to this list, the user must first enter the information in the Maintain Taxes form.

Tax Rate - The rate of the tax. The number in this field is in percentage format. This value will be displayed once the user makes a selection from the List of Values provided in the previous field.

Once the user has finished entering or updating information, they must click the Save button or press F10 to commit the changes to the database.